Insurance > Life Insurance

Life insurance is a financial safeguard that protects your loved ones from the uncertainties of the future. The unpredictable turns of life and unforeseen challenges are enough driving forces to want to protect what matters most to you.

Life is filled with responsibilities and dreams that can sometimes end abruptly. However, with a reassurance safety net, you can have them fulfilled.

Life Insurance is a contract between an insurance company and a policy owner. To get started, the policy owner pays some amount of money to the insurance company then, after the death of the insurance owner, the

As life insurance is a contract between an individual (policyholder) and an insurance company, the policy’s primary purpose is to provide financial benefit for the policy owner beneficiary at the point of the individual(policy owner) or after the agreed term of the policy. To understand how it works, some components make up how to establish a life insurance contract.

To establish the policy, you must purchase it by applying for the policy, while the insurance company considers individual application risk factors like age, health, lifestyle or medical history.

Premium payments follow this process. The individual(policy owner) pays the policy company. This payment could be made monthly, quarterly or annually and determined by factors like coverage amount, type of policy and policy owner risk factor.

There are several types of life insurance which are designed to cater to different goals and different financial needs like guaranteed issue, final expense, group, or universal life insurance variations. However, there are two major types of life insurance you can opt for.

This policy is known to be cheaper but offers long-term insurance strength. But keep in mind that at the expiration of the insurance, you may be able to renew your coverage, but this could be at a higher cost.

There are three kinds of Term Life Insurance;

For insurance known to expire after its durations lapse, remember that renewal rates increase with age, which could lead to an increased premium. Therefore, it’s best to opt for Permanent life insurance rather than an annual renewal at the risk of an increased renewal.

Permanent life insurance is divided into various categories:

This results in the policy owner having access to the cash value during their lifetime through loans or withdrawals. At the death of the policy owner, beneficiaries are given death benefits.

Policy owners also have the flexibility to invest the cash values in various investments. Ensure that you check the guidelines involved with your insurance company.

Before buying life insurance, there are several factors to consider, as life insurance is a long-term financial commitment.

Life Insurance offers several benefits that can provide financial security and peace of mind for individuals and their families. Some of its benefits include:

Life Insurance is essential to ensure financial security for your spouse, children, or other family members in case of your death as an insurance policy owner.

After death, your death benefit could be used to cater to financial expenses like rent, and university fees or even used as an optional retirement income, depending on the policy you opt for.

As an individual considering a life insurance policy, here are some categories of people who may need to register for life insurance.

Qualifying for life insurance involves considering several factors like age, health, lifestyle or financial strength. Most insurance companies use these factors to determine the risk they are undertaking while insuring.

However, be reassured that these factors are only considered to determine the cost of the premium you can pay and how frequently, whether monthly, quarterly or annually.

Life insurance is for anyone who deems fit to need one, not just for the rich or healthy people. But keep in mind that if you have any pre-existing medical condition, it takes a while to approve your insurance, or you may have to pay more than the average person without medical conditions.

The cost of life insurance varies significantly. Various factors influence life insurance, and in turn, life insurance companies evaluate these factors to determine the level of risk associated with insuring an individual. Here are some of the factors that affect life insurance premiums:

Choosing a life insurance beneficiary requires careful consideration as life insurance is an individual who can make a claim of your death benefits after your death.

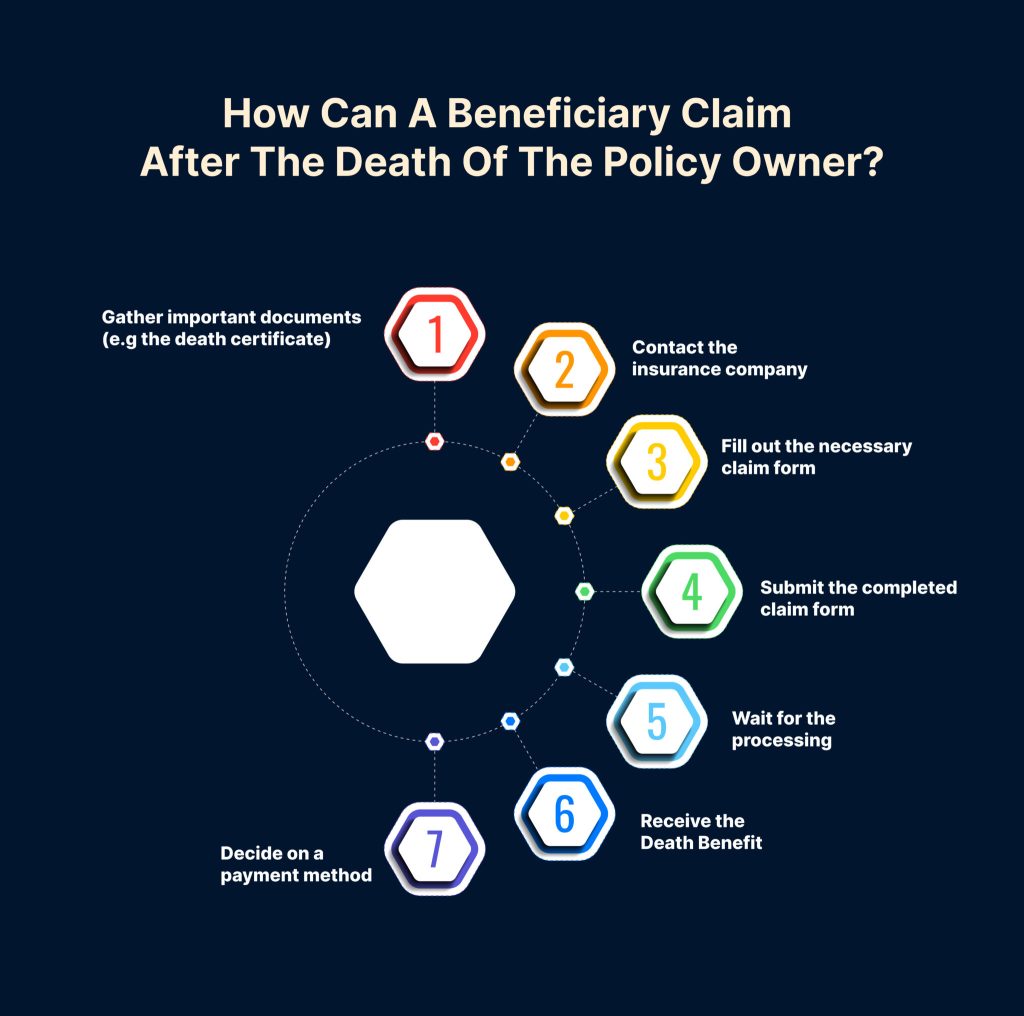

After the death of the policy owner, the beneficiaries are entitled to claim to process the insurance benefit. This can take about a week or two, depending on if you have a complete document. Also, don’t assume the insurance company will contact you.

Here are the processes to follow to claim insurance benefits.

However, the payout options usually depend on the insurance company and the type of policy. These are some popular payout options insurance companies make use of;

Life insurance riders allow policy owners to customise their insurance coverage to suit their preferences and needs. Riders are additional benefits that can be added to a policy to enhance its ability. There are various riders to consider, but availability depends on your insurer. But remember that you must pay additional costs for each rider to become active.