Discover the top loan apps in Nigeria that offer quick access to funds, flexible repayment options, and competitive interest rates, and transform the borrowing experience for individuals and businesses.

Factors to Consider when Choosing Loan Apps

When choosing a loan app, requires careful consideration to ensure the app you choose will fulfil your financial needs and preferences. To be on the safe side, consider the following criteria;

- Interest Rate: Consider the interest rates offered by the loan app you are opting for. An institution with a lower interest rate means a lower overall repayment amount. But also keep in mind that your interest rate is also dependent on your creditworthiness. For some lending apps, the higher your credit score, the higher your interest may be.

- Loan Limit: Check for the range of loan amounts offered by the loan app. It is known that different loan apps offer varying minimum and maximum limits. Ensure the available limit aligns with your financial needs. Some loan apps cater to small short-term needs while others provide larger loans for more significant financial requirements.

- Repayment Terms: Choose a repayment option that aligns with your financial goals and ability to pay a loan without strain. Ensure the loan app you are borrowing from offers flexibility in their repayment terms as some apps allow you to customize your repayment plan. While making these plans, ensure the payment frequency aligns with your income to avoid any penalties.

- Fees: Right before signing up for any loan, consider the fees or charges that may come with that loan. Fees you may want to look out for include;

- Processing Fees: This is a one-time fee charged by the loan app for processing and approving your loan application.

- Customer Reviews: It assess their reliability and trustworthiness. With reviews, you can get insight into the experiences of other users who have used the app. Apart from that, look out for how their customer support handles issues or hidden fees. Their customer reviews will let you know of this information.

- Customer Support: Take into consideration if they have reliable customer support. With a reliable customer support team, you can be assured of getting assistance in cases of issues or technical queries.

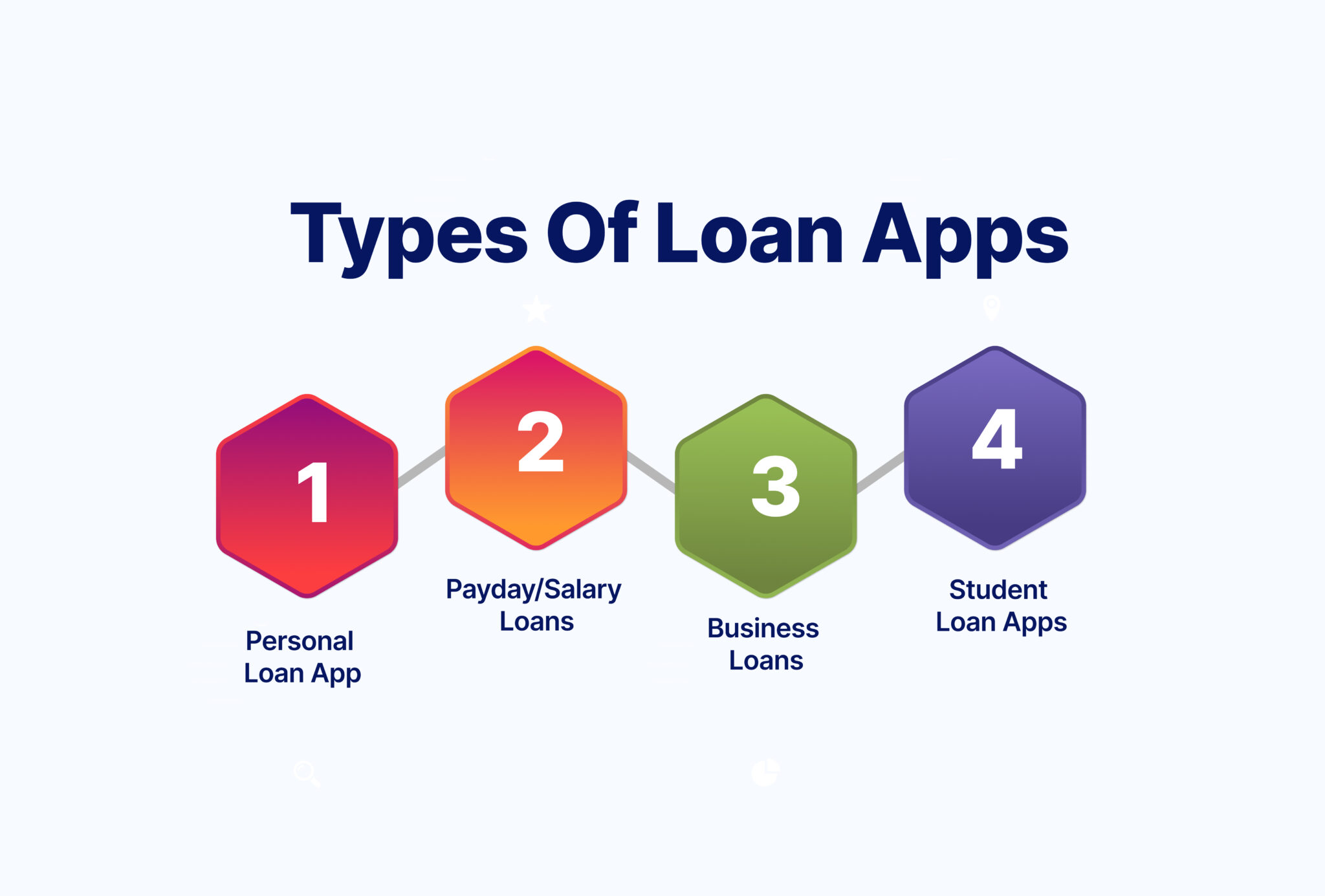

Types of Loan Apps

Various loan apps are available to cater to your financial needs. Here are some common types of loans to explore.

- Personal Loan : It allows loan borrowers to use the borrowed funds for various purposes. One of the main benefits of this loan is its unsecured nature. That is borrowers do not require collateral to get the loan, only your creditworthiness will decide if you can get the loan or not. However, keep in mind that a personal loan has everything fixed. It has a fixed lump sum of money paid out, a fixed interest rate and a fixed repayment schedule. Which is a disadvantage to some individuals. But to be safe stick to what is within your financial means to avoid penalties.

- Payday/Salary loans: These a short-term borrowing to fulfil immediate financial needs. This loan is usually taken out by individuals in dire need of cash before their next salary is paid. Payday repayment is usually due by the next salary payment. The best part about the loan is the quick approval process making the loan suitable for emergencies.

You can explore salary loans on Mintyn bank app

- Business Loans: These are loans specifically made for business owners, to provide funding for various purposes related to their business expansion, operations, or any business-related projects. But keep in mind that there are different types of business loans offered; This includes term loans, equipment financing, startup loans and many other loans.

- Student Loan Apps: Student loans are financial support mainly for students pursuing higher education. This loan covers costs like tuition, books, living costs and other education-related fees.

Best Loan Apps to Explore in Nigeria

Carbon

It is formerly known as (Pay Later) which was founded in 2016 as solely a loan app which gradually became a digital bank by offering a range of financial services. It is an easy-to-use online lending platform that provides short-term and business loans to individuals and businesses without collateral.

Carbon loan amount ranges from 1,500-1m naira and you can get up to 30,000 on your first loan and up to 1,000,000 on your subsequent loans. Carbon loan offers are based on repayment and credit profile. For a 3-month loan of 50,000, you will pay a 2% monthly interest which makes it a total repayment of 53,000 after 90 days.

Pros and Cons of Carbon

| Pros | Cons |

| It is quick and simple: you can request for loan and get it in minutes. | If you are a new customer, it takes some time to upgrade your “Know your Customer level (KYC) |

| No hidden cost: You get a clear breakdown of your loan | Users should be mindful of high-interest rates and fees which can accumulate. overtime. |

| You can apply for a loan extension for a flexible repayment |

How to Apply for a Carbon Loan

- Download the app

- Create an account

- Upgrade your KYC (Know your customer)level

- Apply for the loan accessible to you.

- Your Carbon account will be funded in minutes.

Branch Loan App

Branch App is a financial technology company that provides mobile banking services and loans to individuals. It offers a short-term non-collateral loan to its users through a mobile app resolving the immediate financial needs of individuals.

On the Branch app, repayment terms vary based on the specific loan and borrower’s agreement and their interest rates are often based on the borrower’s risk profile. The typical Branch loan amount ranges from 2,000-500,000 naira with a monthly interest of 1.5%-15% and 1-12 months loan term.

Pros and Cons of Branch Loan App

| Pros | Cons |

| Access to multiple repayment plans | For IOS users, the app is unavailable on the App Store. |

| Offers a competitive interest rate | |

| Does not require collateral |

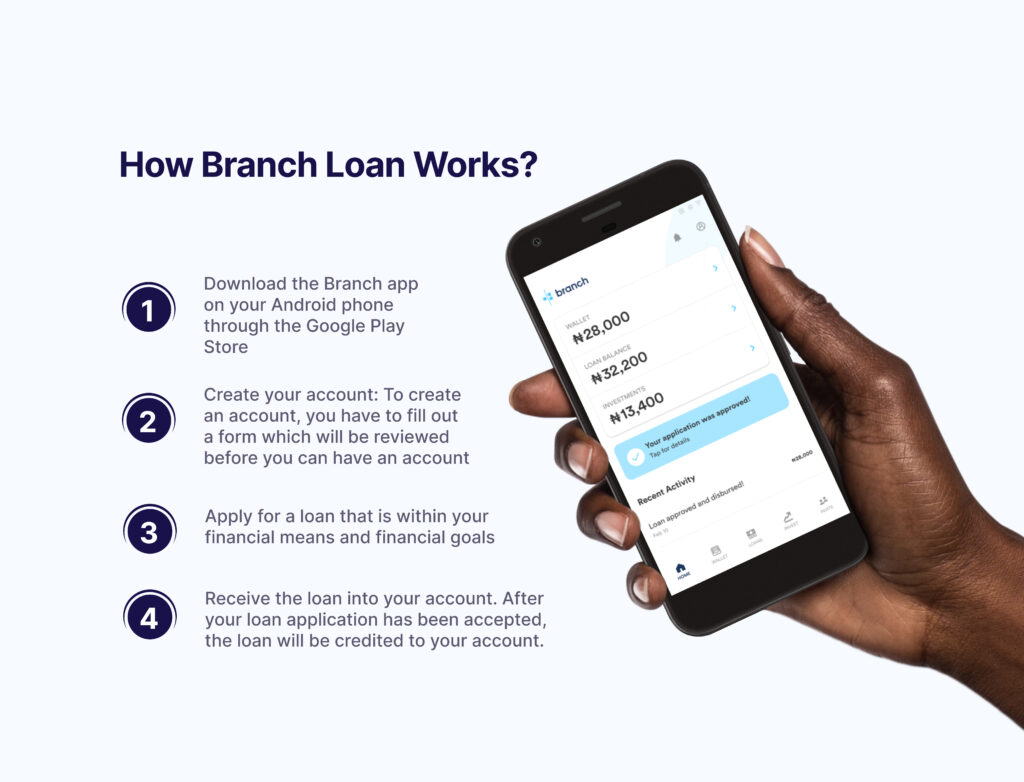

How Branch Loan Works?

- Download the Branch app on your Android phone through the Google Play Store.

- Create your account: To create an account, you have to fill out a form which will be reviewed before you can have an account

- Apply for a loan that is within your financial means and financial goals

- Receive the loan into your account. After your loan application has been accepted, the loan will be credited to your account.

FairMoney

FairMoney is your go-to app for instant loans. It offers a maximum of 5 million in loans to anyone with a (BVN) Bank verification number and a good credit history in Nigeria which includes; entrepreneurs, small businesses, salary earners and others. But it’s important to keep in mind that the initial maximum amount of money for new lenders is 1 million instead of 5 million naira.

Pros and Cons of FairMoney

| Pros | Cons |

| You can enjoy up to 24 months loan period term | The interest rate varies |

| Quick loan: Once you have completed your loan application, you get to access the loan within 5 minutes | First-timers only have access to low maximum loan amounts |

| You do not need collateral to apply for the loan | |

| Gives room for loan extension |

How do I Apply for a FairMoney Loan?

To apply for the loan, there are some requirements you need to have;

- A smartphone

- Means of identification; (NIN) National identification card, voter card, or driver’s license

- Active debit card

- A (BVN) bank verification number.

To apply for a FairMoney loan, Use your smartphone and download the FairMoney app either on the Play Store or App Store depending on your device. Sign up on the app using an active phone number linked to your BVN. This will help them gauge your credit history. Submit your information and follow the in-app instructions and you get your loan in minutes.

To have a better chance of getting the loan, ensure your bank account has a steady and healthy cash flow this indicates you can repay whatever amount you intend to borrow and your phone number is linked to your BVN.

RenMoney

RenMoney is a Microfinance bank formerly known as RenCredit that operates under a CBN banking license.

Pros and Cons of RenMoney

| Pros | Cons |

| Guarantor and collateral-free loan | Firstimers only have access to the highest minimum amount of 50,000 |

| Offers a flexible repayment plan | Unlike other loan apps, Renmoney dictates the amount of loan you can access |

| Renmoney offers small business loans and personal loans to help individuals with finances like buying a car, paying rent, school fees or medical bills |

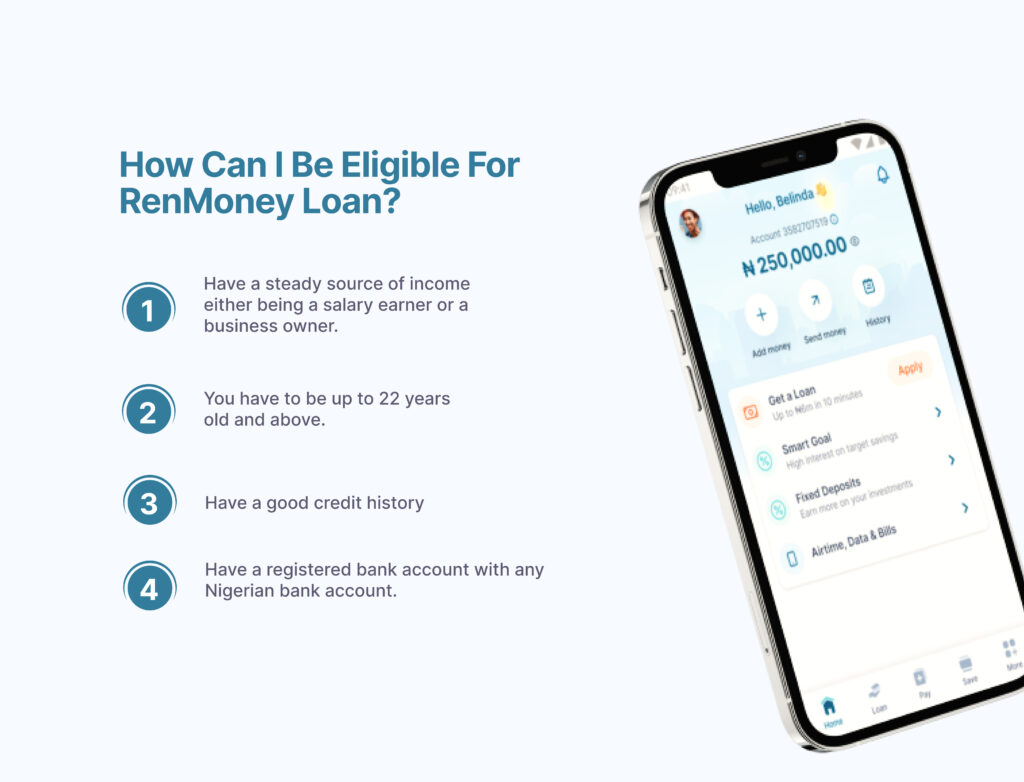

How can I be eligible for RenMoney Loan?

To be eligible for the loan, you have to have the following;

- Have a steady source of income either being a salary earner or a business owner.

- You have to be up to 22 years old and above.

- Have a good credit history

- Have a registered bank account with any Nigerian bank account.

How do I Apply for a RenMoney Loan?

To apply for the loan; You can download the Renmoney app or use their official website, input your information and sign up. However, you will need documents like;

- BVN

- Passport photographs

- A 6 month bank statement

- Identification card

- 3 months utility bill which could be light, water bill, or waste management bill.

Having all these will ease your loan application process with RenMoney.

Aella Credit

Aella Credit is a financial technology company that provides instant loans, credit scoring, and other financial services primarily in Nigeria and other African countries. They focus on offering affordable credit solutions to individuals and businesses through their user-friendly digital platforms.

Pros and Cons of Aella Credit

| Pros | Cons |

| It allows you to choose a repayment plan that suits your needs | Aella credit is majorly available to salary earners |

| Aella instantly process the loan, that is you can easily access the loan | Aella’s loan has a high interest rate. |

| Cashback on loans: you get rewarded for repaying your loan on time | You need to be in Nigeria to access their best loan offers

|

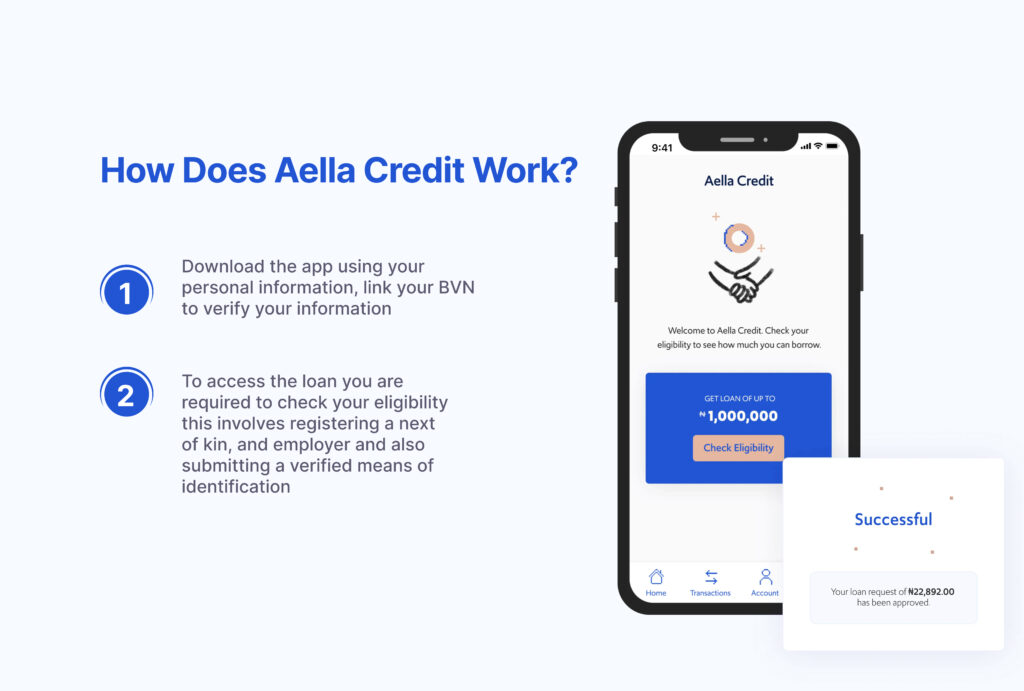

How does Aella Credit work?

- Download the app using your personal information, link your BVN to verify your information

- To access the loan you are required to check your eligibility this involves registering a next of kin, and employer and also submitting a verified means of identification

Keep in mind that CBN licenses all Loan apps mentioned and are NDIC insured.

Overall, when considering the best loan apps in Nigeria, it’s important to assess various factors such as interest rates, loan limits, repayment terms, fees, customer reviews, and customer support. These factors ensure that the chosen loan app aligns with your financial needs and preferences.

Additionally, understanding the different types of loan apps available, such as personal loan apps, payday/salary loan apps, business loan apps, and student loan apps, can help you make informed borrowing decisions based on your specific requirements.

Among the top loan apps to explore are Carbon, Branch Loan App, FairMoney, RenMoney, and Aella Credit, each offering unique features, benefits, and considerations for potential lenders.

By carefully evaluating these options and following the recommended steps for application, borrowers can access quick funds, competitive interest rates, flexible repayment plans, and reliable customer support, ultimately having a better borrowing experience.