Loans > Online Loans

When seeking financial support to manage expenses or merge debts, personal loans emerge as a versatile solution.

A personal loan represents a flexible form of unsecured borrowing. This implies that obtaining approval doesn’t necessitate collateral such as property assets.

Whether you need loan for a car, renovating your home, funding a wedding, or consolidating high-interest debts, opting for a low-interest personal loan might assist you in accomplishing these objectives.

A personal loan permits borrowing a specific amount which is to be repaid in monthly installments over a fixed period. These payments include a fixed interest rate, ensuring consistency in repayments.

The uniform monthly repayments aid in budget management, ensuring borrowing stays within your financial limits.

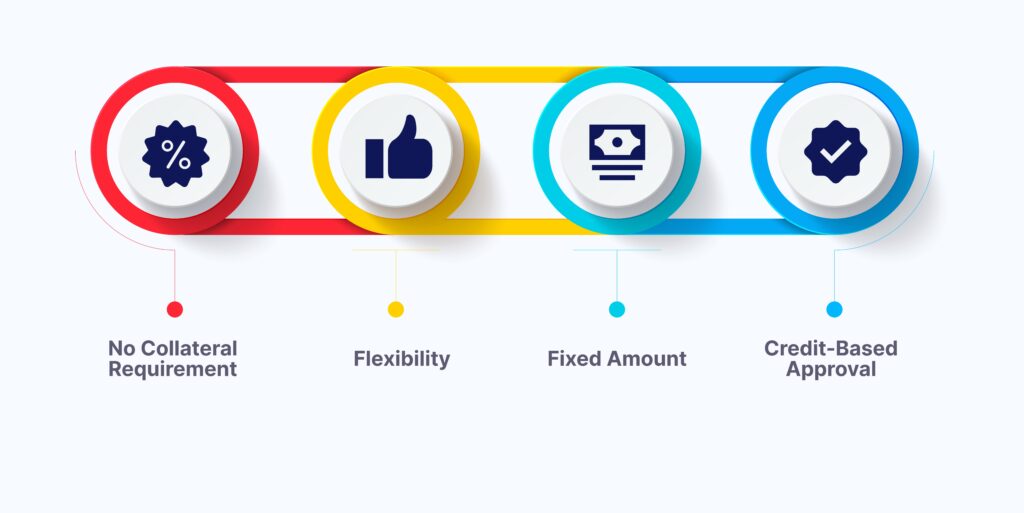

1. No Collateral Requirement: Unlike secured loans (e.g., mortgage or auto loans), personal loans don’t require assets as collateral for approval.

2. Flexibility: These loans can be used for various purposes, such as getting a car, covering unexpected expenses, making home improvements, funding school tuition, or other personal expenditures.

3. Fixed Amount: You receive a predetermined amount upfront and repay it over time in fixed monthly installments.

4. Credit-Based Approval: Eligibility for personal loans is based on your creditworthiness, income, and other financial factors.

The specific documents required for a personal loan may vary slightly depending on the lender and your individual circumstances.

However, generally, you can expect to provide the following documents when applying for a personal loan:

1. Proof of Identity: Valid government-issued photo ID (e.g., driver’s license, passport, or national ID).

Proof of Address.

2. Utility bills: Electricity, water, or gas bills or a rental agreement with your name and current address.

3. Proof of Income: Pay stubs or salary slips for the last few months, tax returns or income statements for self-employed individuals. Proof of additional income sources, if applicable.

4. Employment Verification: Employment verification letter from your employer or a copy of your employment contract.

5. Credit Report: A good credit score improves your chances of approval and favorable terms.

6. Bank Statements: Recent bank statements to demonstrate your financial stability and ability to repay the loan.

1. Online Application: Fill out the online application form, providing personal, financial, and employment details.

2. Documentation: Prepare necessary documents such as identification, proof of income, bank statements, and any additional documents as requested.

3. Loan Selection: Choose the loan amount and repayment term that aligns with your financial needs and capabilities.

4. Review and Submission: Double-check the information provided, review the terms, and submit the application.

5. Loan Approval: Upon approval, review the loan terms, including the interest rate and repayment schedule. If satisfied, accept the offer.

The interest rates on personal loans can vary widely and are influenced by several factors:

1. Creditworthiness: Borrowers with higher credit scores generally qualify for lower interest rates, whereas those with lower scores may face higher rates due to perceived risk.

2. Loan Amount and Term: Larger loan amounts or longer repayment terms may lead to different interest rates.

3. Market Conditions: Economic conditions and fluctuations in the financial market can impact interest rates.

1. Versatility: Can be used for various purposes like debt consolidation, home improvement, emergencies, or major purchases.

2. Quick Access: Generally offer quicker approval and funding compared to other types of loans.

3. No Collateral: Many personal loans are unsecured, not requiring collateral, making them accessible to individuals without substantial assets.

4. Fixed Rates: Some loans offer fixed interest rates, providing predictability in monthly payments throughout the loan term.

5. Credit Building: Timely repayments can positively impact credit scores, improving creditworthiness.

Yes, obtaining a personal loan with bad credit is possible but more challenging. Having a co-signer or improving credit beforehand enhances approval chances.

Ensure to review terms, interest rates, and fees diligently, avoiding predatory lenders.

Car finance is a form of personal loan specifically tailored for purchasing vehicles. While both fall under the category of personal loans, they differ in purpose. Car finance is earmarked exclusively for buying a vehicle, offering structured repayment plans. Personal loans, on the other hand, are versatile and can be used for various purposes.

Car finance often involves the car itself serving as collateral, securing the loan. Creditworthiness influences eligibility for secured or unsecured personal loans. Both provide funds upfront, but car finance is a specialized subset, intricately linked to acquiring a vehicle rather than general financial needs.

Ready to achieve your goals? Apply now and take the first step toward financial empowerment!