Payday loans represent a short financial solution for you in navigating unexpected expenses or emergencies between paychecks. These short-term, unsecured loans are designed to provide quick access to funds when needed most.

How payday loans work

Payday loans are short-term, unsecured loans designed to cover immediate expenses until your next paycheck. To obtain a payday loan, individuals provide proof of employment and a postdated check to the lender. The lender disburses a modest amount with a repayment due on your next payday.

Despite their quick accessibility, payday loans often entail higher interest rates and fees compared to traditional loans, making it crucial for you to understand the terms and use them responsibly to avoid potential financial pitfalls.

Features of payday loans

1. Quick approval process: Payday loans boast a rapid approval system, ensuring you get promptly access funds for urgent financial requirements.

2. Short repayment period: These loans are designed for short-term repayment, usually aligning with the your upcoming payday, distinguishing them from more extended financial commitments.

3. Minimal documentation requirements: Payday loans typically necessitate minimal documentation, emphasizing proof of employment and a postdated check as primary verification.

4. Inclusivity for all credit profiles: If you have diverse credit histories, including those with less-than-perfect credit, you are likely to qualify for payday loans, as lenders prioritize employment verification over credit scores.

5. Fixed charges: Instead of conventional interest rates, payday loans commonly involve fixed fees, providing borrowers with a transparent understanding of the complete repayment amount.

6. Automated repayment system: Many payday lenders facilitate automatic repayment by directly withdrawing the owed sum from your checking account on the agreed-upon due date.

7. Online accessibility: The availability of payday loans online enables you to apply and receive funds without the necessity of visiting physical locations.

8. Flexible eligibility criteria: Lenders often maintain more flexible eligibility criteria, with a primary focus on employment status and income, making payday loans accessible to a broader demographic.

Advantages and disadvantages of payday loans

Advantages of payday loans

Payday loans offer several advantages, particularly in emergency scenarios where individuals require rapid access to funds.

1. Expedited access to funds

A notable advantage of payday loans lies in their prompt processing time. Unlike conventional loans with prolonged approval processes, payday loans are renowned for their swift disbursement, providing borrowers with essential funds within a short timeframe.

2. Minimal eligibility requirements

In contrast to other borrowing options, payday loans typically feature minimal eligibility criteria. Most lenders only necessitate proof of employment, a valid checking account, and a postdated check, enhancing accessibility for individuals with limited credit history.

3. No credit check

Payday loans often do not mandate a rigorous credit check. This characteristic is advantageous for individuals with less-than-perfect credit scores, granting them access to funds when traditional lenders might pose challenges.

4. Convenience in urgent situations

During pressing financial circumstances, such as unforeseen medical expenses or car repairs, payday loans present a convenient resolution. The streamlined application process and swift approval make them a preferred option for those facing time-sensitive financial needs.

Disadvantages of payday loans

While payday loans provide immediate relief, they come with a set of drawbacks that borrowers should thoroughly contemplate before choosing this form of short-term lending.

1. Elevated interest rates

A primary drawback of payday loans is the elevated cost of borrowing. The associated interest rates and fees are notably high, surpassing those of traditional loans significantly. This can potentially lead borrowers into a cycle of debt, especially if repaying the loan in full by the due date proves challenging.

2. Brief repayment periods

Payday loans often come with short repayment terms, typically aligning with the borrower’s next payday. For individuals facing ongoing financial challenges, this brief window can present difficulties in settling the loan in full, resulting in additional fees and penalties.

3. Potential for debt cycle

Due to the combination of high costs and short repayment periods, some borrowers may find themselves ensnared in a debt cycle, continually renewing or rolling over payday loans. This cyclic borrowing pattern can create persistent financial struggles.

4. Limited loan amounts

Despite providing quick access to funds, payday loans usually feature limited loan amounts. This constraint may prove insufficient to cover substantial financial needs, prompting individuals to seek additional loans or alternative funding sources.

While payday loans deliver immediate financial assistance, individuals must carefully evaluate the pros and cons before proceeding. Responsible borrowing entails a thorough understanding of associated costs and implications, ensuring that the benefits align with the borrower’s financial situation and requirements.

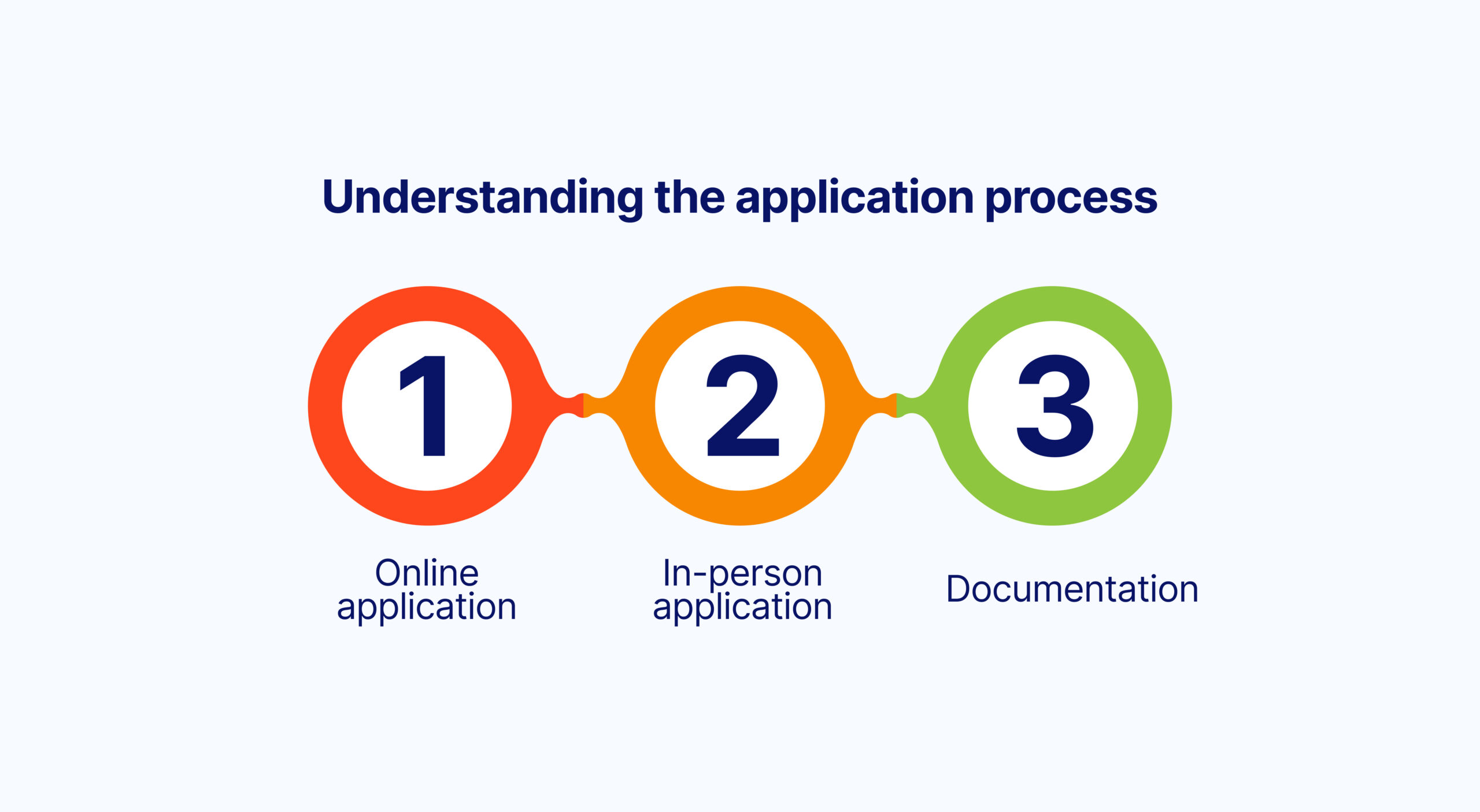

Understanding the application process

Step-by-step guide for applying for a payday loan

Securing a payday loan is a straightforward process, often conducted either online or in-person. The simplicity and efficiency of the application contribute significantly to the popularity of payday loans, particularly in urgent financial situations.

Online application

Start by selecting a reputable payday lender and visiting their website. Complete the online application form, furnishing essential personal and financial details. Ensure accuracy and completeness in your application to expedite the approval process.

In-Person application

Alternatively, certain lenders provide in-person application options. Visit a physical storefront, bringing necessary documentation. Complete the application form provided by the lender and submit any required paperwork.

Documentation

Regardless of the application method, specific documents are typically required. These may include proof of employment, a recent pay stub, a valid ID, and a postdated check. Prepare these documents in advance to streamline the application process.

Required documentation and eligibility criteria

1. Proof of employment

Most payday lenders necessitate proof of consistent employment, such as recent pay stubs or employment verification documents. This serves as assurance that you possess a reliable income source for facilitating loan repayment.

2. Valid ID

A government-issued ID, like a driver’s license or passport, is commonly needed to verify the your identity. This step is crucial for establishing your legal identity and ensuring compliance with regulatory requirements.

3. Checking account information

Lenders usually require information about the your checking account, including the account number and routing number. This is essential for the disbursement of funds and automatic withdrawal for repayment.

4. Age and residency

As an applicant, you must meet age requirements, usually being at least 18 years old. Proof of residency, such as a utility bill or lease agreement, may also be necessary.

Tips for responsible use of payday loans

Navigating the realm of payday loans requires a thoughtful and responsible approach to ensure that these short-term financial tools serve their purpose without plunging borrowers into a cycle of debt. In this section, we explore key tips for the responsible use of payday loans, shed light on understanding repayment terms, and provide insights on avoiding the potentially detrimental cycle of debt.

1. Assess urgency

Reserve payday loans for genuine emergencies and urgent financial needs. Avoid using them for non-essential expenses, as the high costs associated with payday loans are better justified in critical situations.

2. Borrow only what’s necessary

Calculate the exact amount needed to cover the emergency expense. Borrowing more than necessary can lead to increased repayment challenges and higher overall costs.

3. Understand costs

Familiarize yourself with the associated costs, including interest rates and fees. Be transparent with the lender, ensuring that you comprehend the total repayment amount and the implications of any additional charges.

4. Budgeting and planning

Prioritize budgeting and financial planning to prevent the need for frequent payday loans. Establish an emergency fund to address unexpected expenses without relying solely on short-term borrowing.

5. Due date awareness

Payday loans typically have a short repayment period, with the due date aligning with the borrower\’s next paycheck. Ensure a clear understanding of this date to avoid late fees and penalties.

6. Automatic withdrawals

Many payday lenders arrange for automatic withdrawals from the borrower’s checking account on the due date. Confirm the availability of funds to prevent overdraft fees and ensure a smooth repayment process.

7. Open communication

In case of financial challenges, communicate openly with the lender. Some may offer extensions or alternative repayment plans, helping borrowers avoid the pitfalls of defaulting.

How to avoid debt

1. Repay on time

Timely repayment is crucial in preventing the cycle of debt associated with payday loans. Strive to repay the loan on the agreed-upon date to avoid rollovers or extensions that can escalate costs.

2. Limit rollovers

Rollovers or extensions, while sometimes available, often come with additional fees. Limit the use of these options to prevent a continuous cycle of borrowing and accumulating debt.

3. Explore financial counseling

If trapped in a cycle of payday loan dependency, consider seeking financial counseling. Professionals can provide guidance on managing debt, budgeting, and developing healthier financial habits.

How to identify reputable payday lenders

1. Verification of licensing and certification

Legitimate payday lenders conform to licensing requirements established by regulatory authorities. Confirm that the lender holds a valid license to operate in your jurisdiction, a crucial validation of their credibility.

2. Clarity in terms and conditions

Reliable lenders present explicit and thorough terms and conditions. Scrutinize the loan agreement to ensure transparency regarding interest rates, fees, and repayment terms, fostering trust and understanding.

3. Reviewing positive feedback and testimonials

Peruse online reviews and testimonials from past borrowers. Positive endorsements often signify a lender’s dedication to fair and ethical lending practices, providing valuable insights into their reputation.

4. Ensuring website security

Respected lenders prioritize the protection of borrowers’ personal and financial details. Confirm that the lender’s website is secure, with robust encryption measures in place, safeguarding sensitive information.

5. Assessing customer service responsiveness

Evaluate the promptness and professionalism of customer service interactions. A reputable lender is committed to addressing borrower inquiries and concerns promptly, reflecting a commitment to customer satisfaction.

Alternatives to payday loans

While payday loans offer quick financial solutions, it’s essential to explore alternative options that may better suit the individual’s financial circumstances. This section delves into various alternatives and advises on when to consider other types of loans or financial assistance programs.

1. Personal installment loans

Personal installment loans offer a longer repayment period than payday loans. They are suitable for individuals who need a larger sum and prefer spreading repayments over several months.

2. Credit union loans

Credit unions often provide more affordable short-term loans with lower interest rates than traditional payday lenders. Membership criteria may apply, but credit unions prioritize member welfare.

3. Credit card advances

For individuals with available credit on their cards, a credit card cash advance can be a more cost-effective option than payday loans. It typically involves lower fees and interest rates.

4. Emergency savings

Establishing an emergency savings fund can be the most sustainable solution. Regular contributions to this fund create a financial safety net for unexpected expenses, reducing the reliance on short-term loans.

When to consider other types of loans

1. When facing long-term financial struggles

If financial challenges are persistent, seeking advice from financial counselors or exploring long-term solutions, such as debt consolidation or refinancing, may be more appropriate.

2. When eligible for government assistance programs

Government assistance programs, such as low-income subsidies, housing assistance, or utility aid, can provide targeted support without the need for short-term loans.

3. When traditional bank loans are feasible

If credit history allows, traditional bank loans or lines of credit may offer lower interest rates and more favorable terms for borrowers needing a substantial sum over a more extended period.

4. When unemployment benefits are accessible

Unemployed individuals may qualify for unemployment benefits or assistance programs. Exploring these options before resorting to short-term loans is advisable.

Conclusion

In summary, payday loans provide swift relief for individuals navigating urgent financial situations, offering quick access to funds with minimal eligibility requirements. While their advantages, including expedited access and flexible criteria, make them appealing, it is crucial to approach payday loans with caution. Elevated interest rates, short repayment periods, and the potential for a debt cycle necessitate careful consideration.

To use payday loans responsibly, you should assess urgency, borrow only what you think is essential, and comprehend associated costs. Exploring alternative options like personal installment loans or credit union offerings ensures a well-rounded understanding of available financial tools.

Responsible borrowing involves not only obtaining funds promptly but also prudent planning and awareness of potential pitfalls. By making informed decisions, you can leverage payday loans as a temporary solution without compromising long-term financial stability.