Tin Application

At Mintyn, we understand the significance of Tax Identification Number (TIN) for individuals and businesses. TIN is pivotal in maintaining compliance with tax regulations in Nigeria. We offer a swift and streamlined process for your TIN registration, empowering you to meet your tax compliance obligations with confidence and ease.

A Tax Identification Number (TIN) is a unique identifier issued by the Federal Inland Revenue Service (FIRS) to individuals, businesses, or entities to track their tax-related activities. It’s essential for tax compliance, transactions, and other financial activities in Nigeria.

Acquiring a TIN is crucial for several reasons:

1. Tax Compliance: TIN registration ensures adherence to tax laws, aiding in filing tax returns, and fulfilling financial obligations.

2. Legitimacy: It establishes the legitimacy of individuals and businesses in financial transactions and regulatory matters.

3. Business Transactions: TIN is necessary for engaging in various transactions, including contracts, tenders, and other business dealings.

Mintyn simplifies the TIN registration process, making it accessible to all. Our user-friendly platform guides you through the steps, ensuring a seamless experience.

1. Create an Account: Creating an account with Mintyn is an easy ride. Simply sign up here on the website or on mobile app to start your TIN registration process.

2. Provide Details: Enter personal or business information such as business account required for TIN registration, ensuring accuracy and completeness.

3. Document Submission: Upload necessary documents, such as your business CAC registration, identification, proof of address, and any additional requirements stipulated by the FIRS.

4. Track Progress: Monitor your TIN application’s status on Mintyn’s platform and receive updates on its processing stages.

5. Receive Your TIN: Once approved, receive your unique Tax Identification Number from the FIRS through your Mintyn account.

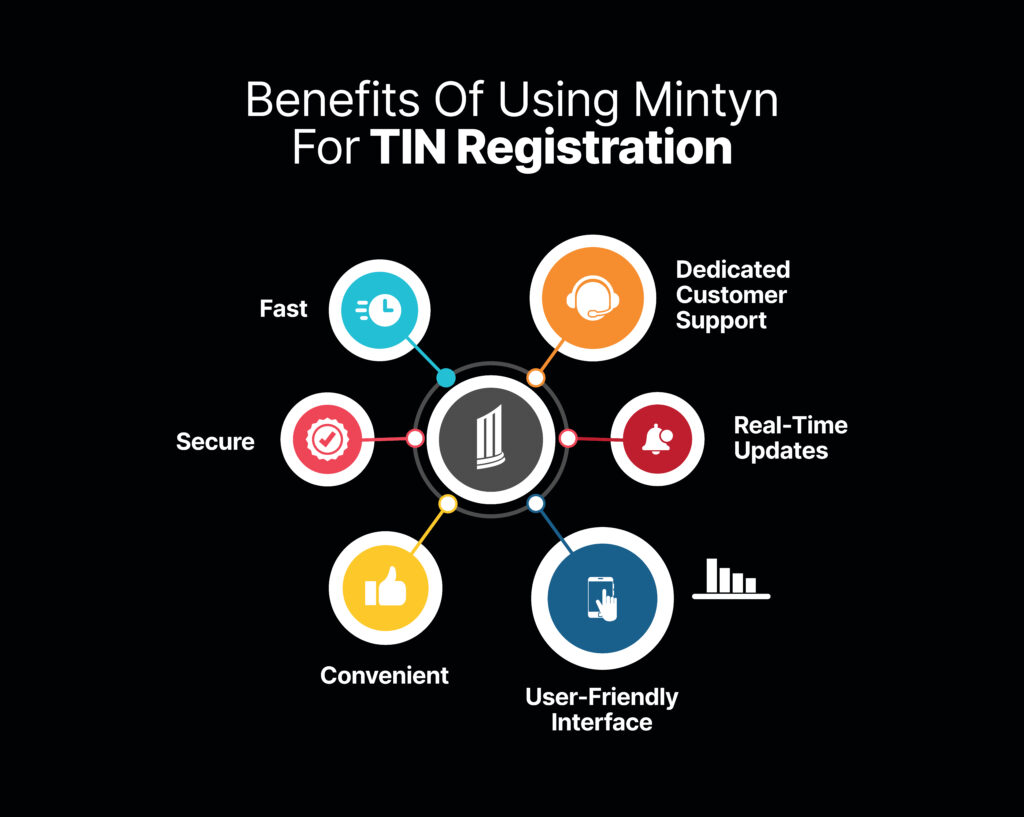

1. Fast

Mintyn prioritizes speed in the application process. Our platform streamlines and accelerates the application process, ensuring prompt handling and processing of your registration. By minimizing bureaucratic hurdles and paperwork, we significantly reduce the time it takes to acquire your Tax Identification Number (TIN). You can expect expedited processing times, allowing them to swiftly move forward with their financial compliance obligations.

2. Secure

At Mintyn, we adhere to stringent protocols to safeguard your data, employing encryption and industry-standard security practices. Rest assured, your privacy and security are paramount when you register for your Tax Identification Number through Mintyn.

3. Convenient

Mintyn stands out for its unparalleled convenience in TIN registration. Our user-friendly interface simplifies the entire process, making it easy and accessible for all users. You can initiate and track your TIN application conveniently from anywhere, whether through our web platform or mobile app. We’ve designed the experience to be intuitive and hassle-free, eliminating complexities and ensuring a seamless journey from start to finish.

4. Dedicated Customer Support

Mintyn takes pride in offering dedicated and responsive customer support throughout your TIN registration journey. Our knowledgeable support team is committed to assisting users at every step of the process. Whether you have inquiries, need guidance, or encounter any issues during registration, our team is readily available to provide prompt assistance.

5. User-Friendly Interface

At Mintyn, we’ve designed our platform with your convenience in mind. Our user-friendly interface offers an intuitive and easy-to-navigate experience for TIN registration. Whether you’re a seasoned user or new to the platform, our interface simplifies the entire process. You can seamlessly initiate your application, input necessary information, and upload required documents without any hassle. Mintyn’s user-centric design ensures a smooth and efficient journey for all users registering for their Tax Identification Numbers.

At Mintyn, our commitment doesn’t end with the TIN registration process. We understand that staying compliant with tax regulations can be complex. That’s why we provide continuous support and guidance to ensure you navigate the tax landscape with confidence. From clarifying tax laws to assisting with filings, our experts are here to empower you every step of the way. Trust Mintyn for comprehensive post-TIN registration support that keeps you on track with your tax obligations.

Titi

“TIN registration used to be a tedious process for me until I found Mintyn. Their platform streamlined everything, making it super easy to acquire my Tax Identification Number. I was amazed by the speed of processing – it was lightning fast! Mintyn’s user-friendly interface and excellent customer support made my experience hassle-free. Highly recommended!”

Harry

“Mintyn made TIN registration a breeze! I was initially skeptical about the process, but their secure platform and dedicated customer support team allayed all my concerns. The real-time updates on my application status were incredibly reassuring. I received my TIN in no time, thanks to Mintyn’s efficiency. Great service!”

Zainab

“Registering for a Tax Identification Number was stress-free with Mintyn. Their convenience and accessibility across devices made the entire process so much easier. I appreciated the tailored notifications that kept me informed throughout. Mintyn’s commitment to security and user-centric design exceeded my expectations. I’m truly impressed!”

Open an account with Mintyn today and secure your TIN!

Start your journey towards financial compliance and legitimacy. Register with Mintyn to acquire your Tax Identification Number promptly and seamlessly.