Loans > Small Business Loans

Are you a small business owner looking to expand your operations or wanting to invest in new equipment? Having access to the right financial resources such as small business loans can make all the difference.

A small business loan is a financial tool specifically crafted to help entrepreneurs meet various business needs.

This loan can be utilized for diverse purposes such as expansion, working capital, equipment purchase, emergency funds, etc.

Choosing the right small business loan is a critical step in fueling your entrepreneurial dreams.

Here’s a step-by-step guide to ensure you choose the perfect small business loan:

1. Assess Your Business Needs

Begin by evaluating your specific requirements. What exactly do you need? Do you need funds for expansion, purchasing inventory, covering operational costs, or something else? Understanding your business’s financial needs is the first step in selecting the right loan.

2. Consider Repayment Flexibility

Look for loans that offer flexibility in repayment schedules.

3. Read the terms and conditions

Before finalizing any loan agreement, carefully read and understand all terms and conditions. Ensure you’re comfortable with the interest rates, repayment structure and ensure you are eligible for the loan.

Click here to learn more.

It’s essential to consider your business’s financial health, revenue projections, and the purpose for which you need the funds before applying for a loan.

Also, having a solid business plan and understanding how the loan fits into your long-term financial strategy is crucial. The loan should align with your business’s goals and financial stability.

Here are some factors that could determine when you should apply for a small business loan.

1. Opportunity for Growth

If there’s an opportunity that could significantly benefit your business (such as acquiring a competitor, launching a new product line, or investing in technology), a timely loan could seize that opportunity.

2. Cash Flow Management

Sometimes, businesses face temporary cash flow gaps due to seasonality or delayed payments from customers.

3. Emergency Situations

Unforeseen emergencies like equipment breakdowns, natural disasters, or sudden market shifts might require immediate funding.

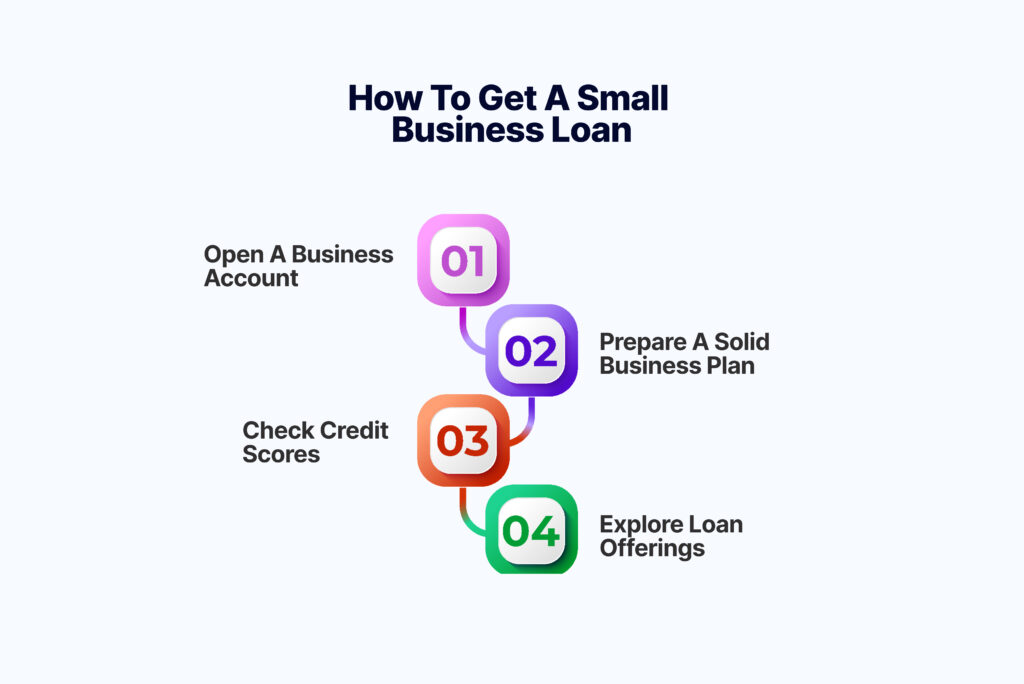

1. Open a business account: Want a small business loan? Opening a business account is crucial. It shows financial responsibility and separates business from personal finances, improving your loan eligibility.

Open an account here.

2. Prepare a Solid Business Plan: Outline your business goals, revenue projections, and how the loan will be utilized.

3. Check Credit Score: Review your personal and business credit scores. Ensure your financial records, including tax returns, are organized and accurate.

4. Explore Loan Offerings: Read and understand terms, interest rates, and eligibility criteria and ensure you are comfortable with the terms and agreement.

Before seeking a small business loan, it’s crucial to determine if a personal guarantee is mandatory. A personal guarantee signifies personal liability for loan repayment if the business fails to do so.

While not all lenders demand a personal guarantee for small business loans, it’s a common requirement. Larger loans often necessitate a personal guarantee, yet negotiation options exist.

The specific loan amount you can obtain will depend on factors such as your business revenue, purpose of the loan, credit score, the loan type, repayment ability, and your eligibility criteria.

Yes, you can obtain small business loans without collateral. These are commonly referred to as unsecured loans. They don’t require specific assets as security but rely on your credit score, business revenue, and sometimes a personal guarantee.

However, unsecured loans might have stricter eligibility criteria and higher interest rates compared to secured loans.

Yes, it’s possible to get a small business loan with bad credit, but it can be more challenging. Expect higher interest rates, stricter terms, or the need for a cosigner or collateral to mitigate the risk for the lender.

Building a strong business plan, showcasing steady revenue, and explaining the circumstances behind your credit score can strengthen your loan application.

Also, improving your creditworthiness over time can increase your chances of obtaining a small business loan despite having bad credit.

In many cases, yes, a small business loan can impact personal credit, particularly if the loan is personally guaranteed or if the lender reports the loan to personal credit bureaus.

The deposit required for a small business varies widely based on factors like startup needs, lease agreements, inventory, and equipment. It can range from initial expenses like permits, inventory costs, to security deposits for leased spaces or utilities. Depending on the business type and industry, this deposit can be modest or substantial.

It’s vital to outline your business plan, consider expenses thoroughly, and anticipate deposits for various necessities while planning your finances for the startup or ongoing operations.

Repayment terms for small business loans vary based on loan types. Typically, they encompass the loan duration (short, medium, or long-term), payment frequency (monthly, quarterly), and interest structure (fixed or variable rates).

Secured loans may require collateral or guarantees, impacting terms. Assessing early repayment penalties and amortization schedules is essential.

Understanding and negotiating suitable repayment terms aligned with your business’s financial capacity is crucial before agreeing to a loan, ensuring manageable payments and a clear repayment plan.

The path to securing a small business loan begins with a strategic decision to separate business from personal finances. The first step on this crucial path to financial prosperity and freedom is opening a business account with Mintyn.

It not only establishes the financial soundness of your company but also builds a strong financial portfolio, which makes you more eligible and credible for loans.

Don’t wait; take this essential step towards achieving your business dreams—open your Mintyn business account today!