Bank Account > Current Account

Our goal is to empower you with the financial tools you need to thrive in today’s world. The current account is key to this; it’s your passport to a seamless and secure way to manage money!

Having a trustworthy partner is very important in an economy where the financial situation is constantly changing. Mintyn is here to be that partner for you. We work hard to come up with new and secure ways to make your banking easy and dependable.

Opening a current account with a digital bank such as Mintyn is a smart choice for many reasons, including:

I. Convenience: Our user-friendly online platform and mobile banking app provide round-the-clock access to your account, making banking very easy.

II. Lower Fees: We believe in straightforward, honest banking. That’s why we don’t burden you with monthly maintenance fees. Your money should be yours; we’re here to ensure you keep more of it.

III. Advanced Security: We employ the latest security measures to protect your information and ensure your peace of mind. With Mintyn, your current account is fortified with top-notch encryption and fraud detection, making it one of the most secure spaces for your money!

IV. Growth Potential: Your current account is a stepping stone to financial growth. At Mintyn, we provide competitive interest rates of up to 18% and other attractive rewards to help your money grow. With us, your financial aspirations can become a reality.

V. Eco-friendly banking: Banking the sustainable way!

VI. Innovative Products and Services: Your secure pathway to various financial tools (CoinBuddy, SpendMapster, PayStream, ThriftyFly,etc)

Ready to begin? Start by opening a current account online with Mintyn today!

A current account is a tool for managing your daily transactions. This flexible account offers unmatched convenience, letting you access, transfer and monitor your funds whenever it suits you.

A Mintyn current account is all online and at your fingertips. A digital current account lets you enjoy the flexibility to set up automatic payments, receive alerts and tailor your banking experience to your lifestyle.

Welcome to hassle-free, accessible and adaptable banking.

A current account is more than just a storehouse for your money; it’s where you conduct your day-to-day financial affairs. Mintyn’s current account offers a range of online and mobile banking services, with zero monthly maintenance fees, real-time alerts, robust security, and dedicated customer support, making it a compelling choice for your modern banking needs.

Join us today and experience the future of banking.

Welcome to Mintyn, where simplicity meets innovation. Our current account is designed to empower you with the essential banking services you need, all at your fingertips. Here’s a glimpse of what makes our Current Account a trusted choice for modern banking.

Make the smart choice for your everyday banking needs. Join Mintyn and experience the future of banking today. Open a Mintyn current account now and enjoy the simplicity and convenience you deserve!

The Application Process

Now that you are ready to take control of your finances, opening a current account with Mintyn is easier than you might think. We believe in simplifying the process to make your banking experience convenient and hassle-free.

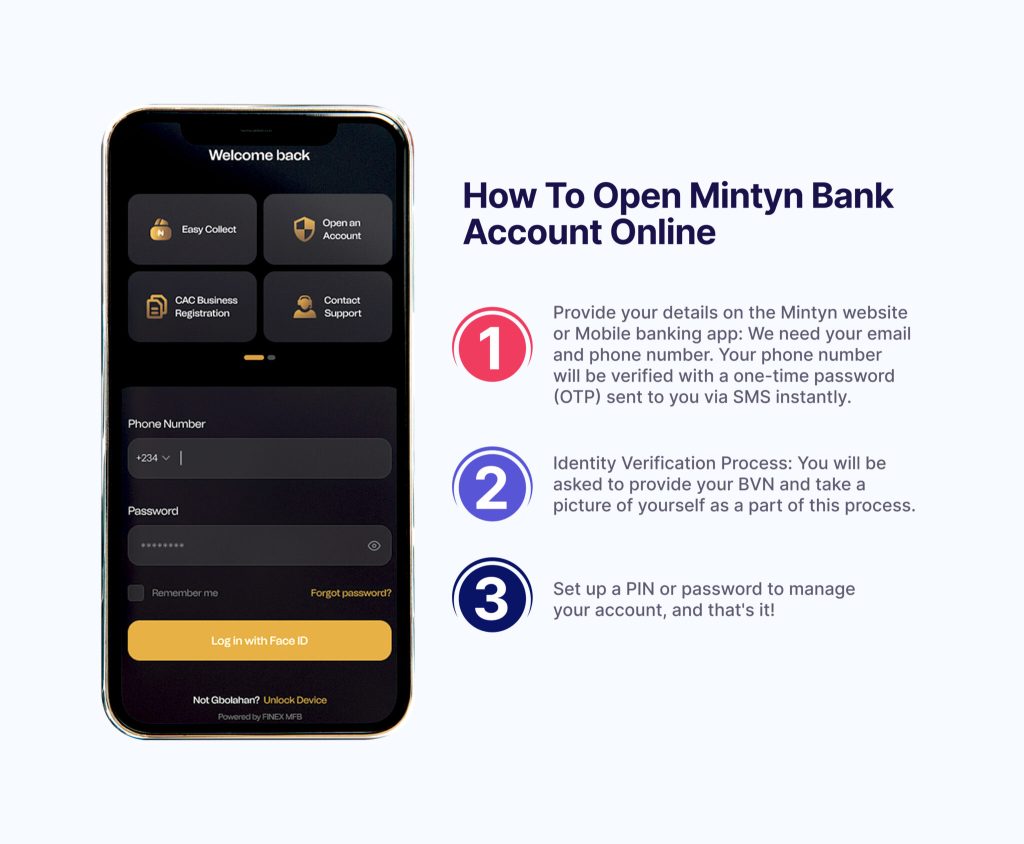

Steps: How to open a Mintyn current account online

1. Provide your details on the Mintyn website or mobile banking app: We need your email and phone number. Your phone number will be verified with a one-time password (OTP) sent instantly via SMS.

2. Identity Verification Process: You will be asked to provide your BVN and take a picture of yourself as a part of this process.

3. Set up a PIN or password to manage your account, and that’s it!

Requirements: What should you have?

1. An internet-enabled device, a smartphone, is preferred.

2. An active phone number and email

3. Your Bank Verification Number (BVN)

4. A valid government-issued form of identification: national ID card, driver’s licence, international passport, etc.

Our digital-first approach ensures that you can provide the necessary documents digitally, making the process efficient and secure.

1. Scanning or Photographs: You can scan your documents or take high-quality photographs of them. Ensure that the images are clear and legible.

2. Secure Upload: Navigate to the document upload section on our website or mobile app. Follow the prompts to upload your documents securely.

3. Verification Process: Our team will review your submitted documents. You’ll receive email updates on your application status, so you’re always in the loop.

By providing the required documents digitally, you save time and resources. It’s part of our commitment to delivering a hassle-free banking experience in today’s fast-paced world.

With your current account application processed smoothly and efficiently, you’ll be ready to enjoy the benefits of modern banking with our digital bank. We look forward to welcoming you as a valued customer and helping you take control of your financial journey.

Our online banking tools and mobile app are designed for your convenience, putting control of your finances at your fingertips.

Online Banking Tools

Effortless Fund Management: Keeping an eye on your finances can be very easy. Our online banking tools offer a straightforward approach to managing your funds, ensuring you always stay in the know.

Checking Balances: Instantly check your account balance anytime, anywhere. No more guesswork or waiting for monthly statements; you can track your balance in real-time.

Transaction History: View your transaction history with a few clicks. Get a detailed breakdown of your spending, making budgeting and financial planning simple!

Setting Up Alerts: Customizable alerts to keep you informed about your account activity. Receive notifications for deposits, withdrawals, or low balances, helping you stay on top of your finances.

Mobile Banking App

Banking on the Go: Our mobile app is your financial companion on the move. Discover the power of banking in the palm of your hand while maintaining the highest level of security.

Mobile Cheque Deposits: Say goodbye to long lines at the bank. Deposit cheques effortlessly by simply snapping a photo through the app. It’s swift, secure, and a game-changer for those who value their time.

Payment Options: Enjoy a comprehensive range of payment options, from transferring funds to paying bills. Our user-friendly interface makes it easy to make payments to anyone, anywhere, at any time.

Unique App Features

What sets our mobile banking app apart? Here are some features that make it extraordinary:

CoinBuddy: CoinBuddy is a budgeting tool by Mintyn that lets you gain complete control of your finances. You are saying goodbye to overspending and hello to financial freedom! CoinBuddy puts you in the driver’s seat, allowing you to track every naira you spend, set realistic goals, and stay accountable. Our app’s user-friendly design and robust features will help you take charge of your wallet and be financially independent!

SpendMapster: SpendMapster is our easy-to-use feature that lets you know where every naira goes. It is easily linked to your cards so that it instantly records your spending as it occurs.

ThriftyFly: This feature helps you find and book wallet-friendly flights. Our goal is to help you maximise the use of your financial resources. You can trust that we will deliver on this.

PayStream: Tired of the tedious process of making multiple payments to different accounts one-by-one? Say goodbye to that hassle and hello to convenience with our new app feature. PayStream makes managing your payments to several accounts as easy as a few taps on your screen.

Card Management: Have you misplaced your card? No problem! Our app allows you to freeze your card temporarily and even order a new one, ensuring your account’s security.

Our unique app features go above and beyond, ensuring your banking experience is as smooth as possible. Your new financial journey starts here! Welcome to the future of banking.

A Mintyn current account is where the future of banking meets environmental responsibility. Embracing digital banking goes beyond the convenience of managing your finances; it’s a step towards a greener, more sustainable future. Mintyn contributes to environmental responsibility by reducing paper usage and minimising your carbon footprint.

Environmental Responsibility

Reduced Paper Usage

In our commitment to environmental responsibility, we’ve significantly reduced the need for paper in your financial transactions. Traditional banking often involves countless sheets of paper for statements, receipts, and documentation. In contrast, Mintyn offers a paperless approach that helps conserve valuable resources.

By opting for our digital Current Account, you play a part in reducing paper production, ultimately saving trees and minimising the environmental impact of paper manufacturing. Say goodbye to physical statements and hello to the convenience of accessing your financial information digitally.

Minimised Carbon Footprint

Every action counts in combating climate change. Traditional banking practices, with their reliance on paper and needing customers to commute to bank branches, have a considerable carbon footprint. In contrast, digital banking is a game-changer in minimising this impact.

When you choose our current account, you choose a bank that cares about the environment. By conducting your financial transactions online, you reduce the need to travel to physical branches, which means fewer cars on the road, less fuel consumption, and reduced greenhouse gas emissions. In other words, it’s not just your financial burden that gets lighter; it’s the environmental burden as well!

How Does Mintyn Make a Difference?

Paperless Statements: Access your account statements, transaction histories, and documents digitally. No more cluttered file cabinets or stacks of paper. Our digital platform lets you securely view, download, and store your financial records.

E-statements: Receive your account statements through secure electronic delivery. Not only do you get quick access to your financial information, but you also help save trees and reduce paper waste.

Online Banking Tools: Our online banking tools, like checking balances and reviewing transactions, promote a greener banking experience. With these features, you can manage your finances efficiently without needing printed documents.

Reduced Travel: With our mobile app and online banking, you can conduct your banking activities from the comfort of your home. There’s no need for frequent visits to a physical branch, cutting down on your carbon emissions and contributing to a cleaner environment.

Join Us in Making a Difference! Start banking with Mintyn today! Choosing our Current Account is not just a decision about your finances; it’s a choice to impact the planet positively.

By reducing paper usage and minimising your carbon footprint, you become part of a global effort to protect our environment! With our changing environmental realities, every action can make a difference, no matter how small!

Together, we can build a greener and more sustainable future. Start your journey towards environmental responsibility today by opening a Current Account with Mintyn! Make your financial decisions count for a cleaner, greener world!

SomtoChukwu

“This bank is the most convenient, user-friendly, and swift bank I have ever experienced in the financial space. It takes me less than a second to log in and consummate my transactions. I’m glad I came across a banking app like Mintyn that bridges my financial transaction needs to be tailored to my lifestyle. Well done, Mintyn, for your extraordinary service”

Asido

“During these difficult times when cash is scarce, Mintyn Bank has proven to be the ideal choice for me when it comes to transfers. The speed is incredibly fast, and payments are received by the recipient faster than ever. Additionally, I love shopping on the Mintyn Marketplace due to the attractive price discounts. Using the Mintyn app is truly amazing”.

Dencillion

“It’s a kind of app and online bank I prefer mostly because it has no stress at all. It is very good and calm to save money, keep it up Mintyn!”

Karen King

“Wait, why didn’t anybody tell me about this @Mintynapp since? So this is what you people have been enjoying? Transferring money without any transfer fee? Nawa oh, I thought we all agreed to help each other.”

Mohammed Ibrahim

“Beautiful app with very good support service. Keep it up!”

Samora I. Fortune

“Guys @Mintynapp is not just a bank. They also offer premium financial services. With MINTYN BANK you can draft your monthly budget, you can view a proper statistics of your income and expenses.”