Life Insurance

In this Page

- First Content

- Second Content

- Third Content

- Fourth Content

Life Insurance

Life insurance is a financial safeguard that protects your loved ones from the uncertainties of the future. The unpredictable turns of life and unforeseen challenges are enough driving forces to want to protect what matters most to you.

Life is filled with responsibilities and dreams that can sometimes end abruptly. However, with a reassurance safety net, you can have them fulfilled.

What is Life Insurance?

Life Insurance is a contract between an insurance company and a policy owner. To get started, the policy owner pays some amount of money to the insurance company then, after the death of the insurance owner, the

How does Life Insurance Work?

As life insurance is a contract between an individual (policyholder) and an insurance company, the policy’s primary purpose is to provide financial benefit for the policy owner beneficiary at the point of the individual(policy owner) or after the agreed term of the policy. To understand how it works, some components make up how to establish a life insurance contract.

To establish the policy, you must purchase it by applying for the policy, while the insurance company considers individual application risk factors like age, health, lifestyle or medical history.

Premium payments follow this process. The individual(policy owner) pays the policy company. This payment could be made monthly, quarterly or annually and determined by factors like coverage amount, type of policy and policy owner risk factor.

Types of Life Insurance

There are several types of life insurance which are designed to cater to different goals and different financial needs like guaranteed issue, final expense, group, or universal life insurance variations. However, there are two major types of life insurance you can opt for.

- Term Life Insurance: Opting for this insurance means you only get coverage for a certain period. This could be 10, 20, or 30 years; the beneficiary gets the death benefits if the individual(policy owner) dies within this period. However, if he/she outlives the specific period, then the policy expires.

This policy is known to be cheaper but offers long-term insurance strength. But keep in mind that at the expiration of the insurance, you may be able to renew your coverage, but this could be at a higher cost.

There are three kinds of Term Life Insurance;

- Decreasing Term Life Insurance is renewable insurance that gradually reduces policy coverage over time during the policy slated period.

- Convertible term life insurance allows the policy owner to convert an insurance policy to a permanent one.

- Increasing term life policy, the coverage amount gradually increases throughout the policy. This could be a good insurance choice for individuals anticipating increasing financial responsibility over time.

For insurance known to expire after its durations lapse, remember that renewal rates increase with age, which could lead to an increased premium. Therefore, it’s best to opt for Permanent life insurance rather than an annual renewal at the risk of an increased renewal.

- Permanent Life Insurance: Permanent life insurance provides coverage for an entire life term, unlike term life, which is only for a specific period. Although it can be expensive, the individual(policy owner) can stay insured for life.

Permanent life insurance is divided into various categories:

- Whole Life Insurance: is a type of permanent insurance that provides coverage for the policy owner’s lifetime. Whole life insurance maintains a level premium and accumulates in cash value.

This results in the policy owner having access to the cash value during their lifetime through loans or withdrawals. At the death of the policy owner, beneficiaries are given death benefits.

- Universal Life Insurance: It is also similar to lifetime insurance, but it offers more flexibility in terms of its premium and death benefits as it allows you to adjust your policy. Just like whole life insurance, ULI also accumulates cash value, which in turn accumulates interest based on the market interest rate.

Policy owners also have the flexibility to invest the cash values in various investments. Ensure that you check the guidelines involved with your insurance company.

- Indexed Universal Life Insurance: It is also a type of universal life insurance that enables policy owners to have a fixed or equity-indexed return on the cash value components.

- Variable Universal Life Insurance: VULI combines the flexibility feature of ULI, as the policy provides you with the flexibility to adjust your premiums and death benefits, and the feature of VUL gives you the flexibility to invest the cash value in different investments of your choice. Thereby, the cash value and death benefit vary based on the performance of the investment.

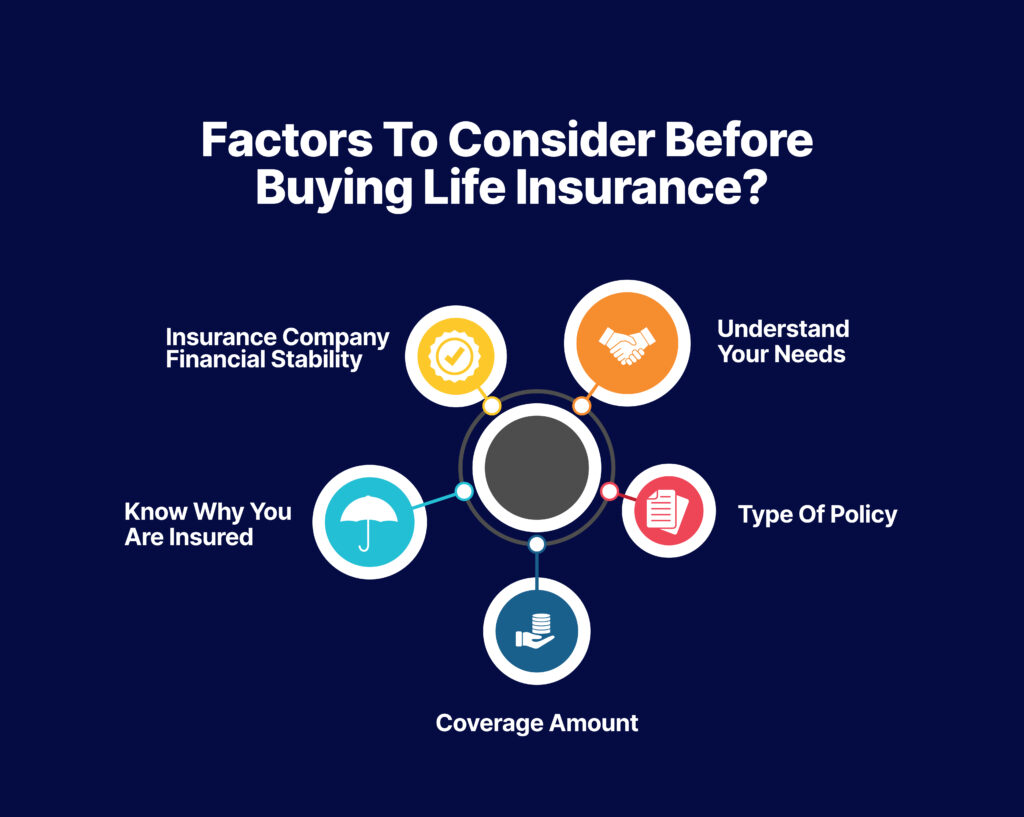

Factors to Consider Before Buying Life Insurance?

Before buying life insurance, there are several factors to consider, as life insurance is a long-term financial commitment.

- Insurance Company Financial Stability: The first thing to do before entertaining thoughts of how your insurance will be or the goals you intend for your life insurance to achieve. Ensure to thoroughly research the insurance company you intend to sign with. You could achieve this by asking questions about online reviews about the company or credit rating agencies. This will help you find out if you are with a financially stable company and guarantee that your beneficiaries will get paid.

- Understand your needs: Before buying life insurance, understand the purpose behind your opting for it and the protection coverage you want after your death. You can consider the following while buying life insurance. The toll of your future death on your immediate family and the financial responsibility your partner has to take on. Life insurance could be an income replacement for your family, help them avoid certain debts and cater to some expenses like education or housing shelter. Understanding these will help you make informed decisions on the type and coverage of insurance you need.

- Know why you are Insured: When opting for life insurance, consider why you are getting the insurance. Could it be for burial expenses? Or a policy that would safeguard your family for the future. But remember that as a family or a parent, you can only buy life insurance for your offspring of up to 25% of their policy value. Also, you might want to look out for permanent life insurance to invest the premium and yield interest over time.

- Type of Policy: The type of policy you intend to opt for also influences your insurance. The main types of insurance, which are term life insurance or permanent insurance, offer different features and benefits. Therefore, equip yourself with the insurance knowledge to consider which policy best suits your budget and needs.

- Coverage Amount: Calculate the amount of coverage by considering your financial obligations, future needs, and the standard of living you intend to provide for your beneficiaries. Consider a coverage that triples your annual income.

Benefits of Life Insurance

Life Insurance offers several benefits that can provide financial security and peace of mind for individuals and their families. Some of its benefits include:

- It offers coverage for Terminal illness: With a death benefit rider, you can adjust your insurance coverage policy. An accelerated death benefit rider allows you to access some or all of your death benefits while you are alive. If you are diagnosed with an illness while you are alive, you can use your death benefit to pay for your health expenses. Also, for situations whereby you require care assistance to perform basic activities like bathing, eating or toileting, your rider benefit can provide funds for your care expenses.

- Supplements for your Retirement Income: Opting for some types of insurance like whole life, universal or variable life insurance with a cash value policy can accumulate your cash value over time. You can access this cash value through loans or withdrawals to cover expenses like buying a car or making a down payment on a home or a source of retirement income.

- Financial protection for your Dependant Expenses: The rule of thumb of an insurance policy is that a policy should be up to 5 or 10 times of the policy owner’s annual income. By maintaining this rule, families who live on your income can still sort out their living expenses without running into debt. With life insurance, you have nothing to worry about your dependents not having enough financial protection with you gone. Also, you may have to increase the amount you should buy if you want your life insurance to cover major expenses like your family’s college expenses.

- For Burial and Final Expenses: After the policy owner’s death, your family worries that your burial could be a significant expense for them, especially if you do not have savings or you are the significant financial decision maker. However, with a life insurance policy, your family can use it to cater for burial expenses, which could be a significant financial relief instead of having to run into debt or spending the little saved up that could be used for other pressing financial expenses.

- They are Tax-Free: Life insurance death benefits aren’t considered as income for tax purposes. They are tax-free for the beneficiaries and the cash value for some life insurance policies also accumulates on a tax-deferred basis.

Who are the People who can Register for Life Insurance

Life Insurance is essential to ensure financial security for your spouse, children, or other family members in case of your death as an insurance policy owner.

After death, your death benefit could be used to cater to financial expenses like rent, and university fees or even used as an optional retirement income, depending on the policy you opt for.

As an individual considering a life insurance policy, here are some categories of people who may need to register for life insurance.

- A parent with young children: After the death of a parent or one of the parents, especially the breadwinner, the dependent may face some financial hardships. But with life insurance, your kids can access essential financial support that can help them along the line till they can finally hold their weight as adults.

- Parents with special-needs children: If you have children or a child with special needs, it could be difficult for them to survive after your death, no matter how old they are. Child/children like this are known to require lifelong care, and there’s nothing more assuring as a parent knowing you have a financial safety net that would guarantee their needs and cater to them after you are gone. For more reassurance, you could have a fiduciary manage the funds for child benefits.

- For parents who wish to leave some money to their children. This could be a reward system for the kids who cared for them while they were alive. If you deem your children worthy of this and you intend to support them even after your death, you can opt for life insurance. For this, you do not necessarily have to buy a large amount, but if you have more than a child, you might want to consider buying a significant amount for them to have an equally substantial amount for financial support.

- Individuals with pre-existing Medical Conditions like diabetes or cancer may seek coverage for any future medical expenses. But be aware that some insurance companies may refuse to provide coverage for such a person while others may charge a higher amount.

- If at any point, took out a loan. If your family or dependents will eventually have to pay for your loan debt, you may want to opt for insurance. This loan could be a private loan or a school loan for your children. With insurance coverage, the families left behind will have enough to cover their debt.

How do I know if I Qualify for Life Insurance?

Qualifying for life insurance involves considering several factors like age, health, lifestyle or financial strength. Most insurance companies use these factors to determine the risk they are undertaking while insuring.

However, be reassured that these factors are only considered to determine the cost of the premium you can pay and how frequently, whether monthly, quarterly or annually.

Life insurance is for anyone who deems fit to need one, not just for the rich or healthy people. But keep in mind that if you have any pre-existing medical condition, it takes a while to approve your insurance, or you may have to pay more than the average person without medical conditions.

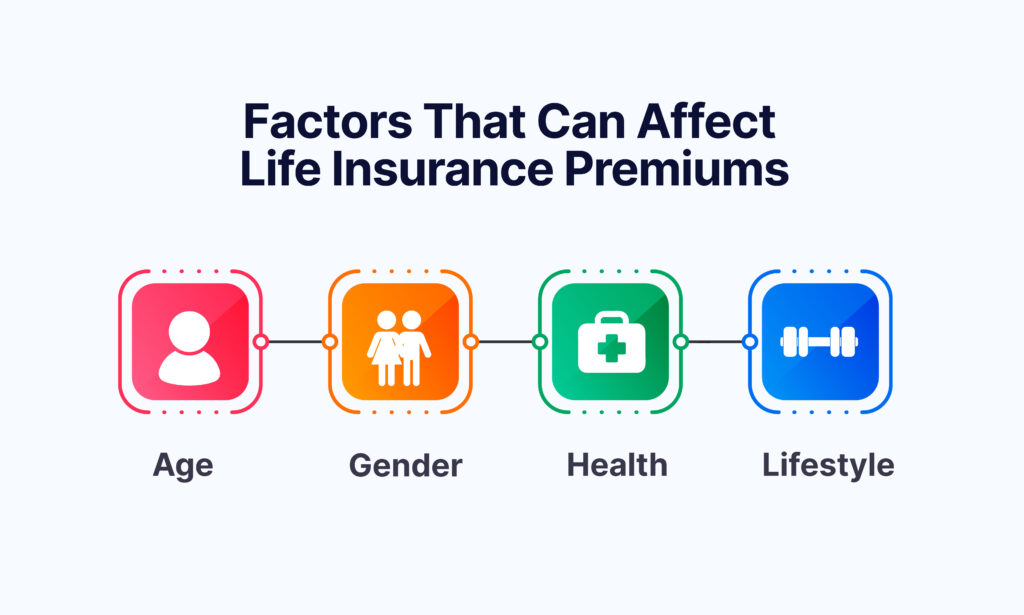

Factors that can Affect Life Insurance Premiums

The cost of life insurance varies significantly. Various factors influence life insurance, and in turn, life insurance companies evaluate these factors to determine the level of risk associated with insuring an individual. Here are some of the factors that affect life insurance premiums:

- Age: It is an important factor as it is considered that the younger you are, the lower the risk associated with insuring you. You are also liable to pay a lower premium because they believe your chance of death or health issues is lower. However, older individuals are liable to face higher premiums due to higher chances of health issues or death.

- Gender: Females are believed to have more life expectancy than men therefore, women pay lesser premiums than men, and women are perceived to have lower risk associated with them than men.

- Health: Your health history is also a significant factor influencing your health insurance premium. They consider you with pre-existing medical conditions. Individuals with serious health conditions may have to pay higher premiums. Family medical history. If your family is known to have a history of medical conditions like heart disease, arthritis or sickle cell anaemia. You are likely to pay more premium.

- Lifestyle: Your lifestyle will also be considered. This includes your occupation or hobby if you have a high-risk job or hobbies that can increase your chances of health or death, this could influence your premium. If you are involved in alcohol consumption or smoking, it could also increase your premium.

How do I Choose a Beneficiary?

Choosing a life insurance beneficiary requires careful consideration as life insurance is an individual who can make a claim of your death benefits after your death.

- Identify your dependant: This is to consider individuals who rely on your financial support and would be affected by your death. This could include the immediate family of the wife and children and the extended family of either the maternal or paternal side.

- Consider primary and Contingent Beneficiaries: Name beneficiaries that will receive your death benefits and the percentage each of them will receive. However, you can further mention contingent beneficiaries that will receive your death benefit if your primary beneficiaries cannot or died before you.

- Consider a Trust: In some cases, you could name a trust as the beneficiary of your death benefit; naming a trust could provide more control over the money and ensure it is spent according to your wish and distributed equally for financial situations.

- Employ a legal and financial adviser: If you decide to name a trust as the beneficiary of your death benefit, ensure you work with a legal adviser to structure the trust and a financial adviser to ensure the trust understands your comprehensive plan. You can also work with them if you have substantial assets or a unique family structure.

- Communicate your Decisions: It is more beneficial to communicate your decisions with your beneficiaries and update them on any corrections or developments to avoid misunderstandings after your death.

- Regularly update and review your beneficiary’s selections: This is important especially after life-changing events like marriage, death of beneficiaries, divorce or birth of children to ensure your insurance decision aligns with your circumstance.

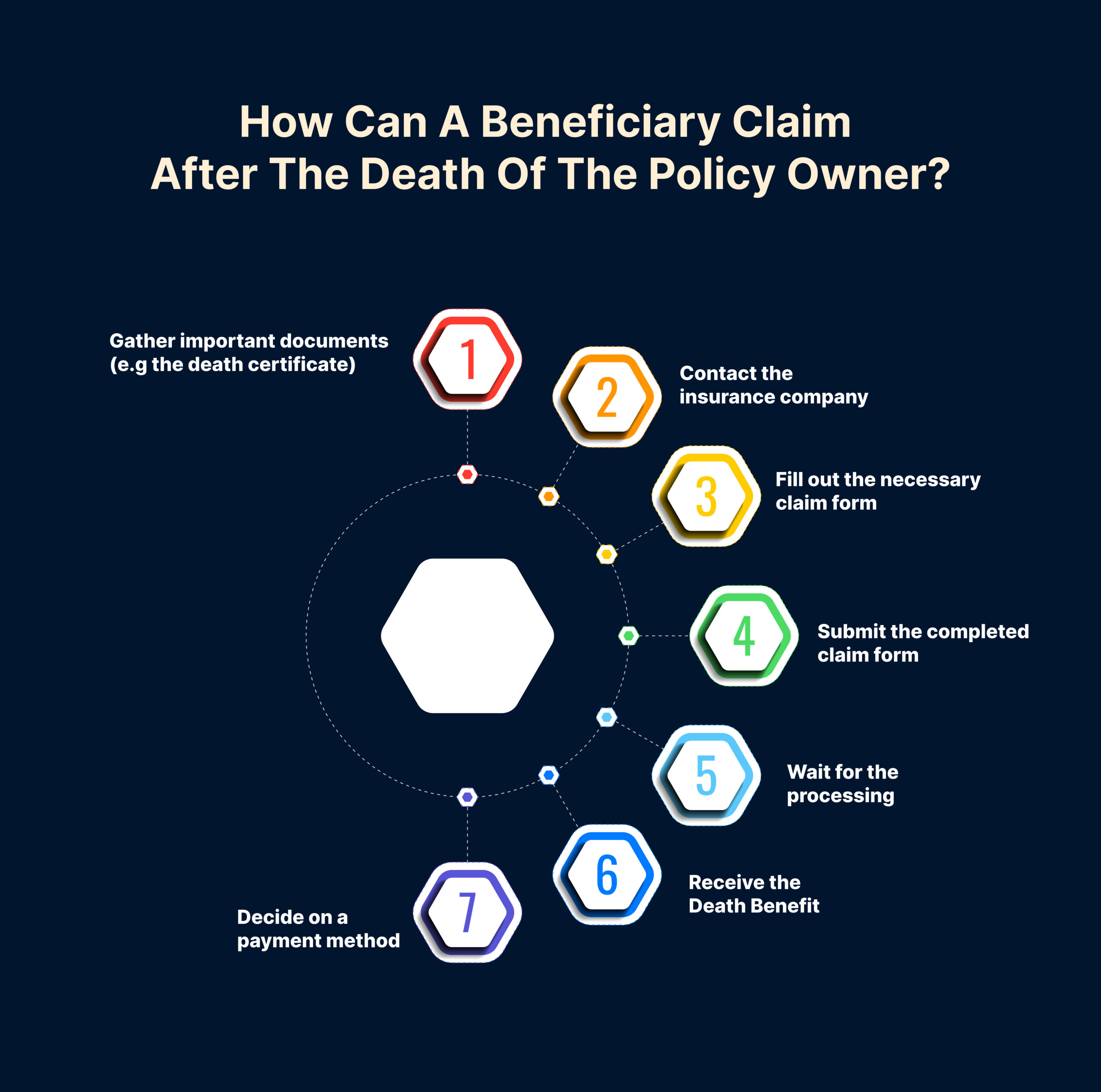

How can a Beneficiary claim after the death of the Policy Owner?

After the death of the policy owner, the beneficiaries are entitled to claim to process the insurance benefit. This can take about a week or two, depending on if you have a complete document. Also, don’t assume the insurance company will contact you.

Here are the processes to follow to claim insurance benefits.

- To make a claim, you need to gather important documents like the death certificate of the policy owner, the original life insurance policy form and other relevant paperwork that will hasten the process.

- After gathering the relevant paperwork, contact the insurance company to inform them of the policy owner’s death. It is important to contact them right away as the sooner you contact them, the sooner you get the benefit to avoid pending bills. After contacting them, the company will guide you through the claim process.

- Fill out the necessary claim form. This will verify you have all the paperwork and include required documentation like the death certificate.

- Submit the completed claim form. You can either be asked to send the completed form through email or submit it in their office physically.

- Wait for the processing. The insurance company will review the processing of the claims, which usually vary. Still, insurance companies are known to process claims quickly.

- Receive the Death Benefit: Once the claim is approved, the insurance company will approve the death benefit to the designated beneficiaries. The payment is usually made in a lump sum.

- Decide on a payment method. For the benefit payment method, there are several options you can consider for a life insurance payout.

However, the payout options usually depend on the insurance company and the type of policy. These are some popular payout options insurance companies make use of;

- LumpsumPayout Option: Beneficiaries receive the benefit claim in a single payment.

- Specific Income Payout: This option allows the beneficiary to receive the payout in instalments over a certain period or a specific timeframe and several payments.

- Life income with period certain payout: The payout is converted into an annuity granting beneficiaries payments at a certain period.

- Retained asset account payout: Beneficiaries retain the payment with the insurance company in an interest-earning account, which is only accessible when needed.

- Life income payout: The payout is converted into an annuity, providing beneficiaries with lifetime payments.

Life Insurance Riders

Life insurance riders allow policy owners to customise their insurance coverage to suit their preferences and needs. Riders are additional benefits that can be added to a policy to enhance its ability. There are various riders to consider, but availability depends on your insurer. But remember that you must pay additional costs for each rider to become active.

- The Accident Death Benefit Rider.Provides additional death benefit to the policy owner if the death results from an accident.

- The Disability Income Rider. Pays part of the benefit to the policy owner if, at any point, he/she becomes sick and unable to work for several months.

- A guaranteed insurability rider permits the policy owner to purchase additional insurance later without undergoing a medical review.

- The long-term care rider is a form of accelerated death benefit. It can be used to cover the cost of a nanny, in-house nurse or nursing home, and the policy owner will need help with activities like bathing, eating and toileting.

Frequently Asked Questions

In this Page

- First Content

- Second Content

- Third Content

- Fourth Content